State-space models

Jan-Ole Koslik

State_space_models.RmdBefore diving into this vignette, we recommend reading the vignette Introduction to LaMa.

This vignette shows how to fit state-space models which can be interpreted as generalisation of HMMs to continuous state spaces. Several approaches exist to fitting such models, but Langrock (2011) showed that very general state-space models can be fitted via approximate maximum likelihood estimation, when the continuous state space is finely discretised. This is equivalent to numerical integration over the state process using midpoint quadrature.

Here, we will showcase this approach for a basic stochastic volatility model which, while being very simple, captures most of the stylised facts of financial time series. In this model the unobserved marked volatility is described by an AR(1) process:

g_t = \phi g_{t-1} + \sigma \eta_t, \qquad \eta_t \sim N(0,1), with autoregression parameter \phi < 1 and dispersion parameter \sigma. Share returns y_t can then be modelled as y_t = \beta \epsilon_t \exp(g_t / 2), where \epsilon_t \sim N(0,1) and \beta > 0 is the baseline standard deviation of the returns (when g_t is in equilibrium), which implies y_t \mid g_t \sim N(0, (\beta e^{g_t / 2})^2).

Simulating data from the stochastic volatility model

We start by simulating data from the above specified model:

beta = 2 # baseline standard deviation

phi = 0.95 # AR parameter of the log-volatility process

sigma = 0.5 # variability of the log-volatility process

n = 1000

set.seed(123)

g = rep(NA, n)

g[1] = rnorm(1, 0, sigma / sqrt(1-phi^2)) # stationary distribution of AR(1) process

for(t in 2:n){

# sampling next state based on previous state and AR(1) equation

g[t] = rnorm(1, phi*g[t-1], sigma)

}

# sampling zero-mean observations with standard deviation given by latent process

y = rnorm(n, 0, beta * exp(g/2))

# share returns

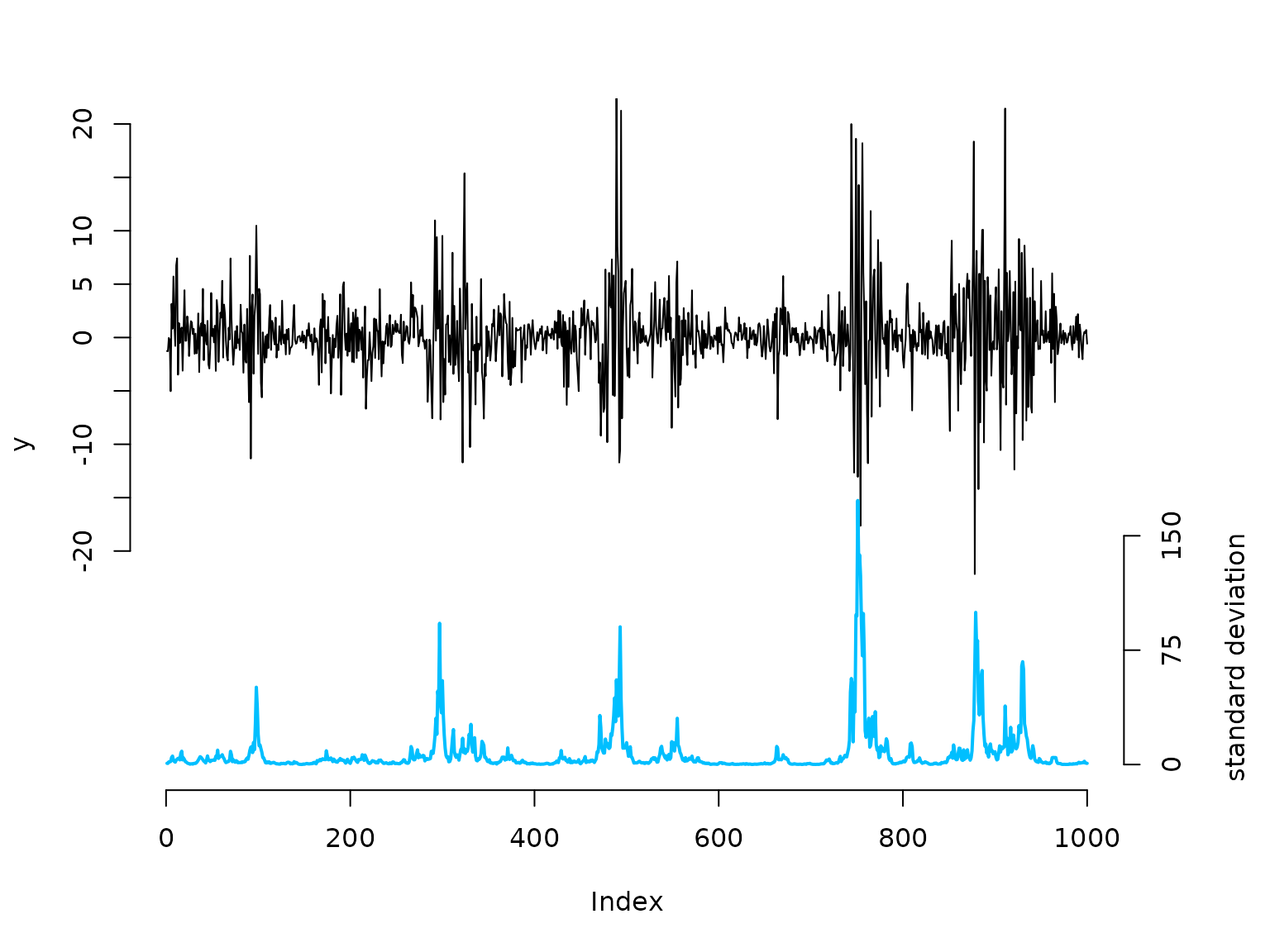

oldpar = par(mar = c(5,4,3,4.5)+0.1)

plot(y, type = "l", bty = "n", ylim = c(-40,20), yaxt = "n")

# true underlying standard deviation

lines(beta*exp(g)/7 - 40, col = "deepskyblue", lwd = 2)

axis(side=2, at = seq(-20,20,by=5), labels = seq(-20,20,by=5))

axis(side=4, at = seq(0,150,by=75)/7-40, labels = seq(0,150,by=75))

mtext("standard deviation", side=4, line=3, at = -30)

par(oldpar)Writing the negative log-likelihood function

To calculate the likelihood, we need to integrate over the state

space. We approximate this high-dimensional integral using a midpoint

quadrature which ultimately results in a fine discretisation of the

continuous state space into the intervals b with width

h and midpoints bstar (Langrock

2011). Thus, the likelihood below corresponds to a basic HMM

likelihood with a large number of states.

nll = function(par, y, bm, m){

phi = plogis(par[1])

sigma = exp(par[2])

beta = exp(par[3])

b = seq(-bm, bm, length = m+1) # intervals for midpoint quadrature

h = b[2] - b[1] # interval width

bstar = (b[-1] + b[-(m+1)]) / 2 # interval midpoints

# approximating t.p.m. resulting from midpoint quadrature

Gamma = sapply(bstar, dnorm, mean = phi * bstar, sd = sigma) * h

delta = h * dnorm(bstar, 0, sigma / sqrt(1-phi^2)) # stationary distribution

# approximating state-dependent density based on midpoints

allprobs = t(sapply(y, dnorm, mean = 0, sd = beta * exp(bstar/2)))

# forward algorithm

-forward(delta, Gamma, allprobs)

}Results

## parameter estimates

(phi = plogis(mod$estimate[1]))

#> [1] 0.9516567

(sigma = exp(mod$estimate[2]))

#> [1] 0.4436876

(beta = exp(mod$estimate[3]))

#> [1] 2.184006

## decoding states

b = seq(-bm, bm, length = m+1) # intervals for midpoint quadrature

h = b[2]-b[1] # interval width

bstar = (b[-1] + b[-(m+1)])/2 # interval midpoints

Gamma = sapply(bstar, dnorm, mean = phi*bstar, sd = sigma) * h

delta = h * dnorm(bstar, 0, sigma/sqrt(1-phi^2)) # stationary distribution

# approximating state-dependent density based on midpoints

allprobs = t(sapply(y, dnorm, mean = 0, sd = beta * exp(bstar/2)))

# actual decoding

probs = stateprobs(delta, Gamma, allprobs) # local/ soft decoding

states = viterbi(delta, Gamma, allprobs) # global/ hard decoding

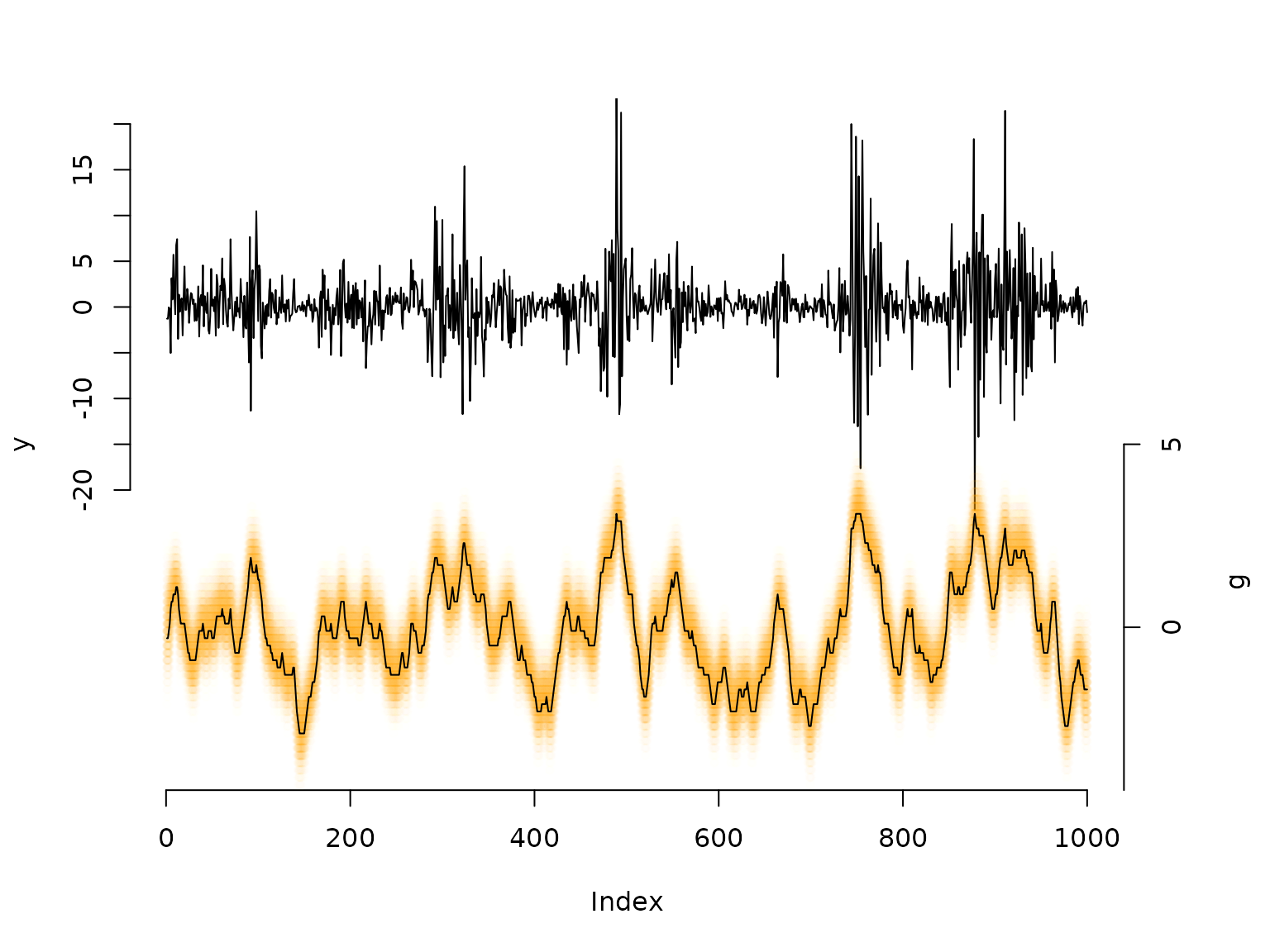

oldpar = par(mar = c(5,4,3,4.5)+0.1)

plot(y, type = "l", bty = "n", ylim = c(-50,20), yaxt = "n")

# when there are so many states it is not too sensible to only plot the most probable state,

# as its probability might still be very small. Generally, we are approximating continuous

# distributions, thus it makes sense to plot the entire conditional distribution.

maxprobs = apply(probs, 1, max)

for(t in 1:nrow(probs)){

colend = round((probs[t,]/(maxprobs[t]*5))*100)

colend[which(colend<10)] = paste0("0", colend[which(colend<10)])

points(rep(t, m), bstar*4-35, col = paste0("#FFA200",colend), pch = 20)

}

# we can add the viterbi decoded volatility levels as a "mean"

lines(bstar[states]*4-35)

axis(side=2, at = seq(-20,20,by=5), labels = seq(-20,20,by=5))

axis(side=4, at = seq(-5,5, by = 5)*4-35, labels = seq(-5,5, by = 5))

mtext("g", side=4, line=3, at = -30)

par(oldpar)