Penalised splines

Penalised_splines.RmdBefore diving into this vignette, we recommend reading the vignettes Introduction to LaMa, Inhomogeneous HMMs, Periodic HMMs and LaMa and RTMB.

This vignette explores how LaMa can be used to fit

models involving nonparametric components, represented by

penalised splines. The main idea here is that it may be

useful to represent some relationships in our model by smooth functions

for which the functional form is not pre-specified, but flexibly

estimated from the data. For HMM-like models, this is particularly

valuable, as the latent nature of the state process makes modelling

choices more difficult. For example, choosing an appropriate parametric

family for the state-dependent distributions may be difficult as we

cannot do state-specific EDA before fitting the model. Also very

difficult is the dependence of transition probabilities on covariates as

the transitions are not directly observed. Hence, the obvious

alternative is to model these kind of relationships flexibly using

splines but imposing a penalty on the smoothness of the estimated

functions. This leads us to penalised splines.

LaMa contains helper functions that build

design and penalty matrices for given

formulas (using mgcv under the hood) and also functions to

estimate models involving penalised splines in a random effects

framework. For the latter to work, the penalised negative

log-likelihood needs to be compatible with the R package

RTMB to allow for automatic differentiation

(AD). For more information on RTMB, see the

vignette LaMa and RTMB or check out its documentation. For

more information on penalised splines, we recommend Wood (2017).

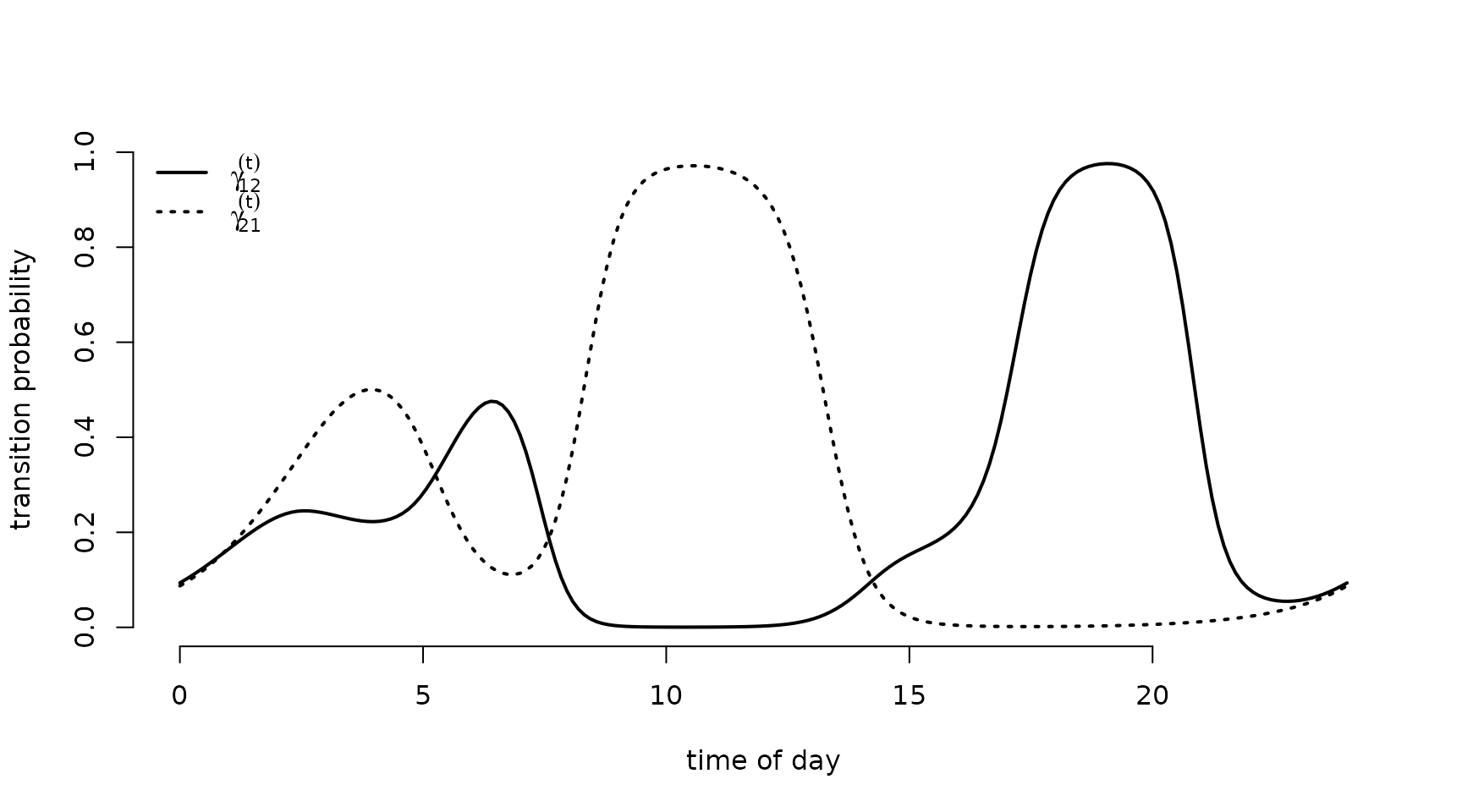

Smooth transition probabilities

We will start by investigating a 2-state HMM for the

trex data set, containing hourly step lengths and turning

angles of a Tyrannosaurus rex living 66 million years ago. The

transition probabilities are modelled as smooth functions of the time of

day using cyclic P-Splines. The relationship can be

summarised as

\text{logit}(\gamma_{ij}^{(t)}) = \beta_0^{(ij)} + s_{ij}(t), where s_{ij}(t) is a smooth periodic function of time of day. We model the T-rex’s step lengths and turning angles using state-dependent gamma and von Mises distributions.

To ease with model specification, LaMa provides the

function make_matrices() which creates

design and penalty matrices for

regression settings based on the R package mgcv. The user

only needs to specify the right side of a formula using

mgcv syntax and provide data. Here, we use

s(tod, by = "cp") to create the matrices for cyclic

P-splines (cp). This results in a cubic B-Spline basis,

that is wrapped at boundary of the support (0 and 24). We then append

both resulting matrices to the dat list.

library(LaMa)

#> Loading required package: RTMB

head(trex)

#> tod step angle state

#> 1 9 0.3252437 NA 1

#> 2 10 0.2458265 2.234562 1

#> 3 11 0.2173252 -2.262418 1

#> 4 12 0.5114665 -2.958732 1

#> 5 13 0.3828494 1.811840 1

#> 6 14 0.4220099 1.834668 1

modmat = make_matrices(~ s(tod, bs = "cp"), # formula

data = data.frame(tod = 1:24), # data

knots = list(tod = c(0, 24))) # where to wrap the cyclic basis

Z = modmat$Z # spline design matrix

S = modmat$S # penalty matrixWe can now specify the penalised negative log-likelihood

function. The transition probability matrix can be computed the

regular way using tpm_g(). In the last line we need to add

the curvature penalty based on S, which we can conveniently

do using penalty().

pnll = function(par) {

getAll(par, dat)

# cbinding intercept and spline coefs, because intercept is not penalised

Gamma = tpm_g(Z, cbind(beta0, betaSpline))

# computing all periodically stationary distributions for easy access later

Delta = stationary_p(Gamma); REPORT(Delta)

# parameter transformations

mu = exp(logmu); REPORT(mu)

sigma = exp(logsigma); REPORT(sigma)

kappa = exp(logkappa); REPORT(kappa)

# calculating all state-dependent densities

allprobs = matrix(1, nrow = length(step), ncol = N)

ind = which(!is.na(step) & !is.na(angle)) # only for non-NA obs.

for(j in 1:N){

allprobs[ind,j] = dgamma2(step[ind],mu[j],sigma[j]) * dvm(angle[ind],0,kappa[j])

}

-forward_g(Delta[tod[1],], Gamma[,,tod], allprobs) + # regular forward algorithm

penalty(betaSpline, S, lambda) # this does all the penalisation work

}We also have to append a lambda vector to our

dat list which is the initial penalty

strength parameter vector. In this case it is of length two

because our coefficient matrix has two rows.

If you are wondering why lambda is not added to the

par list, this is because for penalised likelihood

estimation, it is a hyperparameter, hence not a true

parameter in the sense of the other parameters in par. One

could, at his point, just use the above penalised likelihood function to

do penalised ML for a fixed penalty strength

lambda.

par = list(logmu = log(c(0.3, 2.5)), # state-dependent mean step

logsigma = log(c(0.2, 1.5)), # state-dependent sd step

logkappa = log(c(0.2, 1.5)), # state-dependent concentration angle

beta0 = c(-2, 2), # state process intercepts

betaSpline = matrix(rep(0, 2*(ncol(Z)-1)), nrow = 2)) # spline coefs

dat = list(step = trex$step, # observed steps

angle = trex$angle, # observed angle

N = 2, # number of states

tod = trex$tod, # time of day (used for indexing)

Z = Z, # spline design matrix

S = S, # penalty matrix

lambda = rep(100, 2)) # initial penalty strengthThe model fit with automatic smoothness selection can then be

conducted by using the qreml() function contained in

LaMa. The quasi restricted maximum

likelihood algorithm finds a good penalty strength parameter

lambda by treating the spline coefficients as random

effects. Under the hood, qreml() also constructs an AD

function with RTMB but uses the qREML

algorithm (Koslik 2024) to fit the

model. We have to tell the qreml() function which

parameters are spline coefficients by providing the name of the

corresponding list element of par.

There are some rules to follow when using qreml():

The likelihood function needs to be

RTMB-compatible, i.e. have the same structure as the likelihood functions in the vignette LaMa and RTMB. Most importantly, it should be a function of the parameter list only.The penalty strength vector

lambdaneeds its length to correspond to the total number of spline coefficient vectors used. In our case, this is the number of rows ofbetaSpline, but if we additionally had a different spline coefficient (with a different name) in our parameter list, possibly with a different length and a different penalty matrix, we would have needed more elements inlambda.The

penalty()function can only be called once in the likelihood. If several spline coefficients are penalised,penalty()expects a list of coefficient matrices or vectors and a list of penalty matrices. This is shown in the third example in this vignette.

- By default,

qreml()assumes that the penalisation hyperparameter in thedatobject is calledlambda. You can use a different name fordat(of course then changing it in yourpnllas well), but if you want to use a different name for the penalisation hyperparameter, you have to specify it as a character string in theqreml()call using thepsnameargument.

system.time(

mod1 <- qreml(pnll, par, dat, random = "betaSpline")

)

#> Creating AD function

#> Initialising with lambda: 100 100

#> outer 1 - lambda: 32.051 31.828

#> outer 2 - lambda: 10.555 10.748

#> outer 3 - lambda: 3.659 3.977

#> outer 4 - lambda: 1.41 1.589

#> outer 5 - lambda: 0.669 0.693

#> outer 6 - lambda: 0.426 0.347

#> outer 7 - lambda: 0.346 0.21

#> outer 8 - lambda: 0.32 0.153

#> outer 9 - lambda: 0.312 0.129

#> outer 10 - lambda: 0.309 0.119

#> outer 11 - lambda: 0.308 0.114

#> outer 12 - lambda: 0.308 0.113

#> Converged

#> Final model fit with lambda: 0.308 0.113

#> user system elapsed

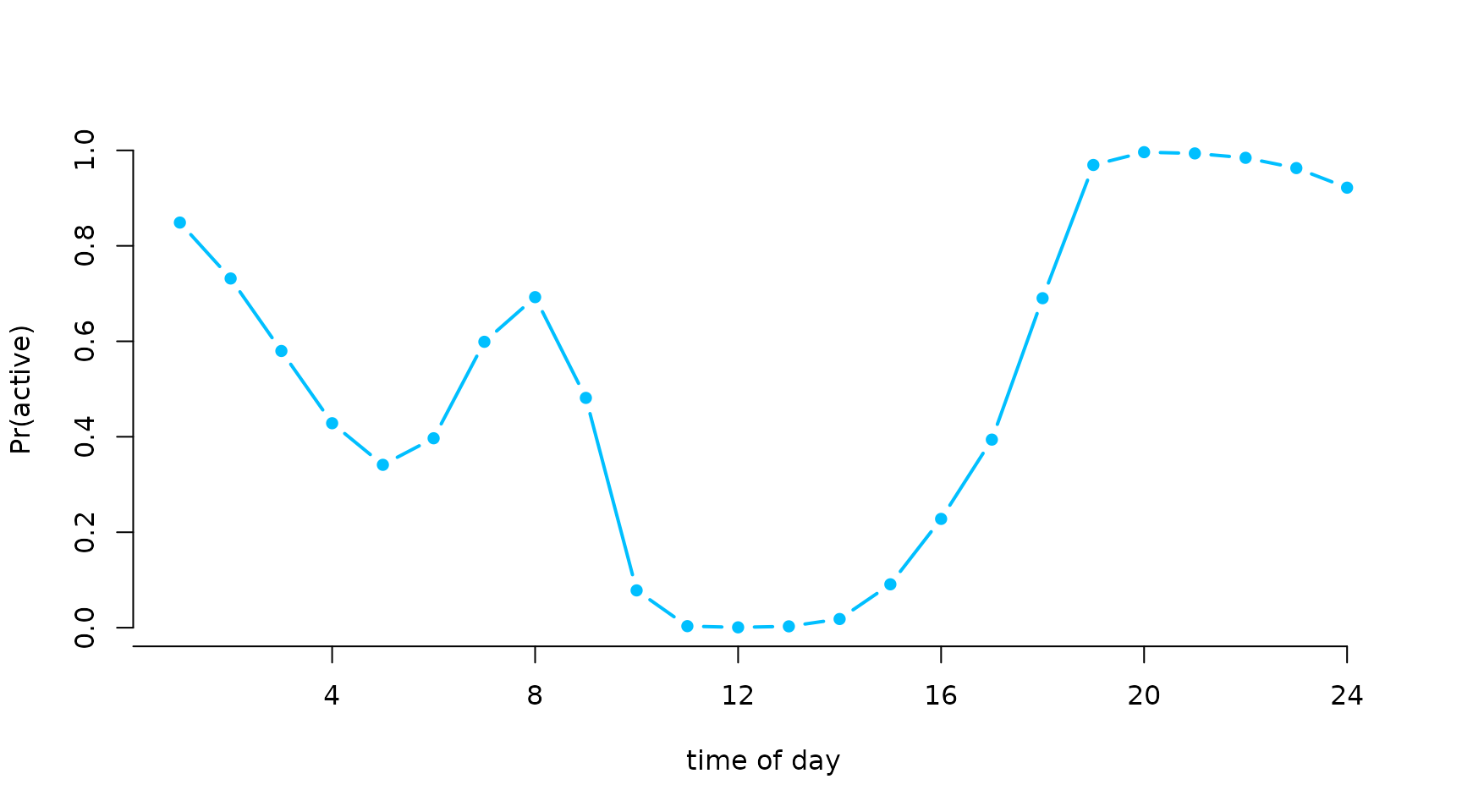

#> 6.093 2.987 5.622The mod object is now a list that contains everything

that is reported by the likelihood function, but also the

RTMB object created in the process. After fitting the

model, we can use predict() with the modmat

object we created earlier to build a new interpolating design matrix

using the exact same basis expansion specified above. This allows us to

plot the estimated transition probabilities as a smooth function of time

of day.

Delta = mod1$Delta

tod_seq = seq(0, 24, length = 100)

Z_p = predict(modmat, data.frame(tod = tod_seq))

Gamma_plot = tpm_g(Z_p, mod1$beta) # interpolating transition probs

plot(tod_seq, Gamma_plot[1,2,], type = "l", lwd = 2, ylim = c(0,1),

xlab = "time of day", ylab = "transition probability", bty = "n")

lines(tod_seq, Gamma_plot[2,1,], lwd = 2, lty = 3)

legend("topleft", lwd = 2, lty = c(1,3), bty = "n",

legend = c(expression(gamma[12]^(t)), expression(gamma[21]^(t))))

plot(Delta[,2], type = "b", lwd = 2, pch = 16, xlab = "time of day", ylab = "Pr(active)",

col = "deepskyblue", bty = "n", xaxt = "n")

axis(1, at = seq(0,24,by=4), labels = seq(0,24,by=4))

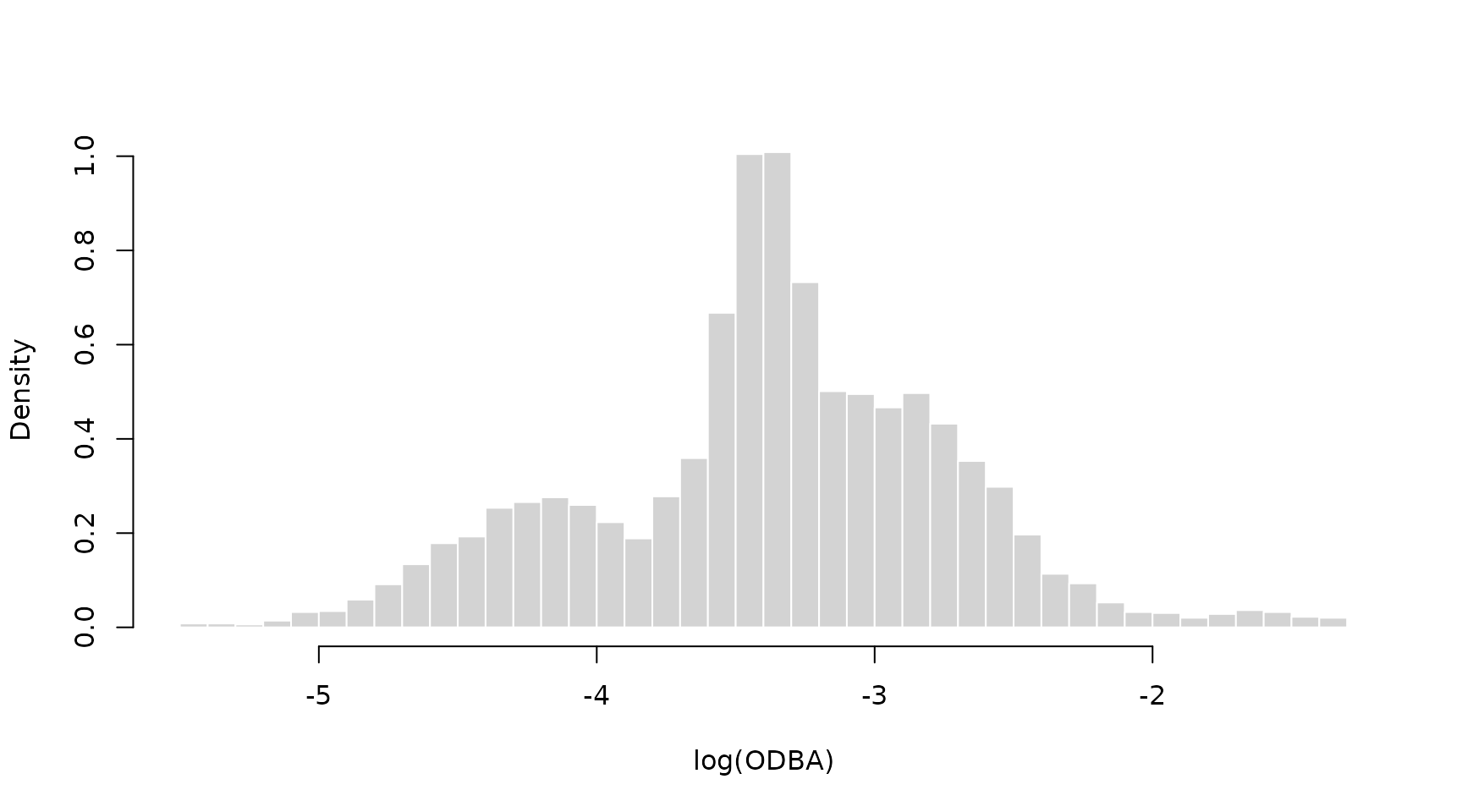

Smooth density estimation

To demonstrate nonparametric estimation of the state-dependent

densities, we will consider the nessi data set. It contains

acceleration data of the Loch Ness Monster, specifically the

overall dynamic body acceleration (ODBA). ODBA is

strictly positive with some very extreme values, making direct analysis

difficult. Hence, for our analysis we consider the logarithm of ODBA as

our observed process.

head(nessi)

#> ODBA logODBA state

#> 1 0.03775025 -3.276763 2

#> 2 0.05417830 -2.915475 2

#> 3 0.03625247 -3.317248 2

#> 4 0.01310802 -4.334531 1

#> 5 0.05402441 -2.918319 3

#> 6 0.06133794 -2.791357 3

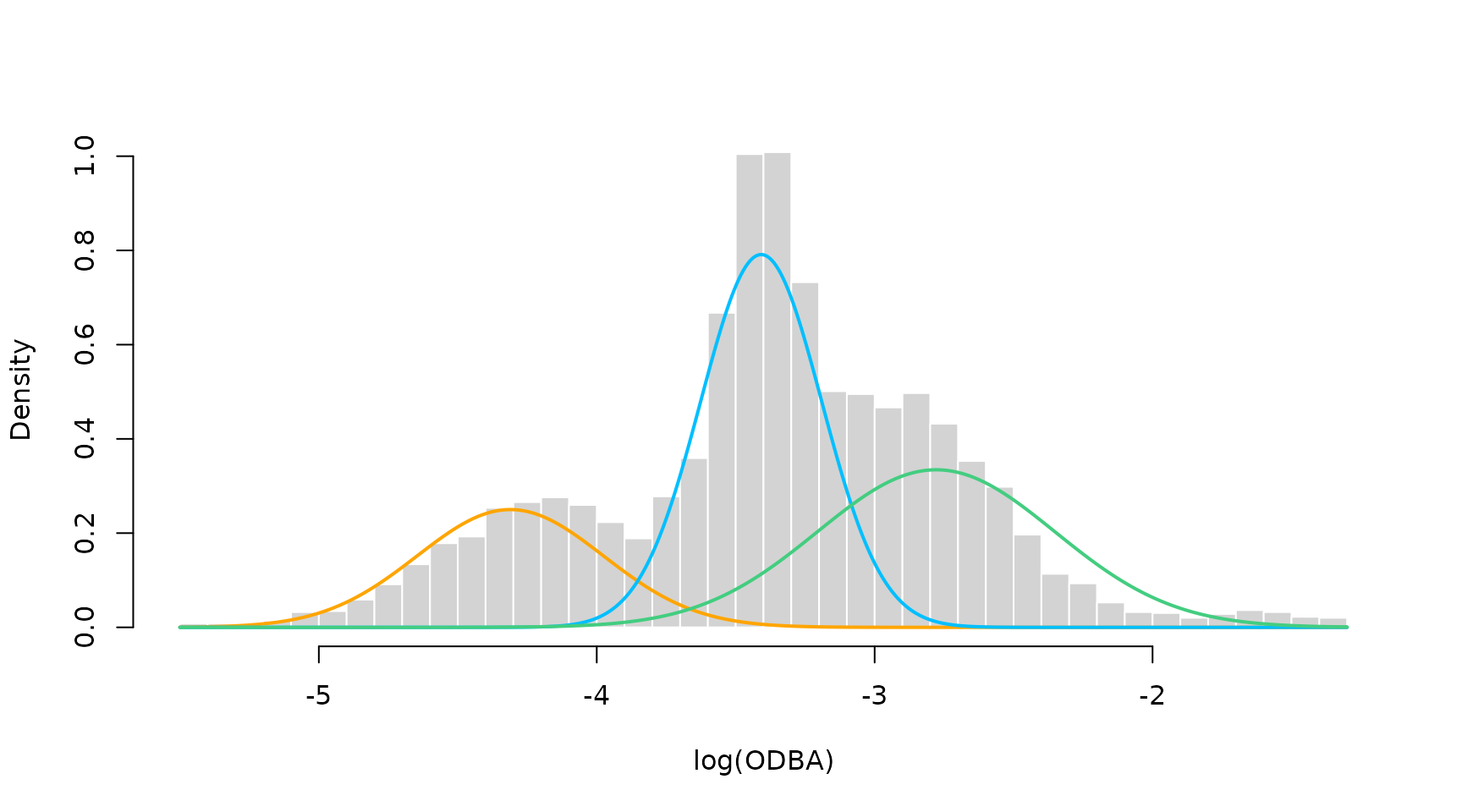

hist(nessi$logODBA, prob = TRUE, breaks = 50, bor = "white",

main = "", xlab = "log(ODBA)")

Clearly, there are at least three behavioural states in the data, and we start by fitting a simple 3-state Gaussian HMM with likelihood function:

nll = function(par){

getAll(par, dat)

sigma = exp(logsigma) # exp because strictly positive

REPORT(mu); REPORT(sigma)

Gamma = tpm(eta) # multinomial logit link

delta = stationary(Gamma) # stationary dist of the homogeneous Markov chain

allprobs = matrix(1, length(logODBA), N)

ind = which(!is.na(logODBA))

for(j in 1:N) allprobs[ind,j] = dnorm(logODBA[ind], mu[j], sigma[j])

-forward(delta, Gamma, allprobs)

}We then fit the model as explained in the vignette LaMa and RTMB.

# initial parameter list

par = list(mu = c(-4.5, -3.5, -2.5),

logsigma = log(rep(0.5, 3)),

eta = rep(-2, 6))

# data and hyperparameters

dat = list(logODBA = nessi$logODBA, N = 3)

# creating automatically differentiable objective function

obj = MakeADFun(nll, par, silent = TRUE)

# fitting the model

opt = nlminb(obj$par, obj$fn, obj$gr)

# reporting to get calculated quantities

mod = obj$report()

# visualising the results

color = c("orange", "deepskyblue", "seagreen3")

hist(nessi$logODBA, prob = TRUE, breaks = 50, bor = "white",

main = "", xlab = "log(ODBA)")

for(j in 1:3) curve(mod$delta[j] * dnorm(x, mod$mu[j], mod$sigma[j]),

add = TRUE, col = color[j], lwd = 2, n = 500)

We see a clear lack-of-fit due to the inflexibility of the Gaussian state-dependent densities. Thus, we now fit a model with state-dependent densities based on P-Splines.

In a first step, this requires us to prepare the

design and penalty matrices needed

using smooth_dens_construct(). This function can take

multiple data streams and a set of initial parameters (specifying

initial means and standard deviations) for each data stream. It then

builds the P-Spline design and penalty matrices for

each data stream as well as a matrix of initial spline

coefficients based on the provided parameters. The basis

functions are standardised such that they integrate to one, which is

needed for density estimation.

# providing initial means and sds to initialise spline coefficients

par0 = list(logODBA = list(mean = c(-4, -3.3, -2.8), sd = c(0.3, 0.2, 0.5)))

# construct the smooth density objects

modmat = smooth_dens_construct(nessi["logODBA"], # only one data stream here

par = par0)

#> logODBA

#> Leaving out last column of the penalty matrix, fix the last spline coefficient at zero for identifiability!

#> Parameter matrix excludes the last column. Add a (fixed) zero column using 'cbind(coef, 0)' in your loss function!

# par is nested named list: top layer: each data stream

# for each data stream: initial means and standard deviations for each state

# objects for model fitting

Z = modmat$Z$logODBA # spline design matrix for logODBA

S = modmat$S$logODBA # penalty matrix for logODBA

beta = modmat$coef$logODBA # initial spline coefficients

# objects for prediction

Z_p = modmat$Z_predict$logODBA # prediction design matrix

xseq = modmat$xseq$logODBA # prediction sequence of logODBA valuesThen, we can specify the penalised negative log-likelihood function.

The six lines in the middle are needed for P-Spline-based density

estimation. The coefficient matrix beta provided by

buildSmoothDens() has one column less than the number of

basis functions, which is also printed when calling

buildSmoothDens(). This is because the last column,

i.e. the last coefficient for each state, needs to be fixed to zero for

identifiability which we do by using

cbind(beta, 0). Then, we transform the unconstrained

parameter matrix to non-negative weights that sum to one (called

alpha) for each state using the inverse multinomial

logistic link (softmax). The columns of the allprobs matrix

are then computed as linear combinations of the columns of

Z and the weights alpha. Lastly, we penalise

the unconstrained coefficients beta (not the constrained

alpha’s) using the penalty() function.

pnll = function(par){

getAll(par, dat)

# regular stationary HMM stuff

Gamma = tpm(eta)

delta = stationary(Gamma)

# smooth state-dependent densities

alpha = exp(cbind(beta, 0))

alpha = alpha / rowSums(alpha) # multinomial logit link

REPORT(alpha)

allprobs = matrix(1, nrow(Z), N)

ind = which(!is.na(Z[,1])) # only for non-NA obs.

allprobs[ind,] = Z[ind,] %*% t(alpha)

# forward algorithm + penalty

-forward(delta, Gamma, allprobs) +

penalty(beta, S, lambda)

}Now we specify the initial parameter and data list and fit the model.

In this case, we actually don’t need to add the observations to our

dat list anymore, as all the information is contained in

the design matrix Z.

par = list(beta = beta, # spline coefficients prepared by smooth_dens_construct()

eta = rep(-2, 6)) # initial transition matrix on logit scale

dat = list(N = 3, # number of states

Z = Z, # spline design matrix

S = S, # spline penalty matrix

lambda = rep(10, 3)) # initial penalty strength vector

# fitting the model using qREML

system.time(

mod2 <- qreml(pnll, par, dat, random = "beta")

)

#> Creating AD function

#> Initialising with lambda: 10 10 10

#> outer 1 - lambda: 4.213 3.833 4.836

#> outer 2 - lambda: 2.309 1.937 3.045

#> outer 3 - lambda: 1.604 1.332 2.338

#> outer 4 - lambda: 1.305 1.127 2.028

#> outer 5 - lambda: 1.166 1.053 1.883

#> outer 6 - lambda: 1.099 1.026 1.812

#> outer 7 - lambda: 1.065 1.016 1.777

#> outer 8 - lambda: 1.048 1.012 1.76

#> outer 9 - lambda: 1.04 1.01 1.75

#> outer 10 - lambda: 1.035 1.01 1.747

#> outer 11 - lambda: 1.034 1.01 1.745

#> outer 12 - lambda: 1.033 1.01 1.745

#> outer 13 - lambda: 1.033 1.01 1.744

#> Converged

#> Final model fit with lambda: 1.033 1.01 1.744

#> user system elapsed

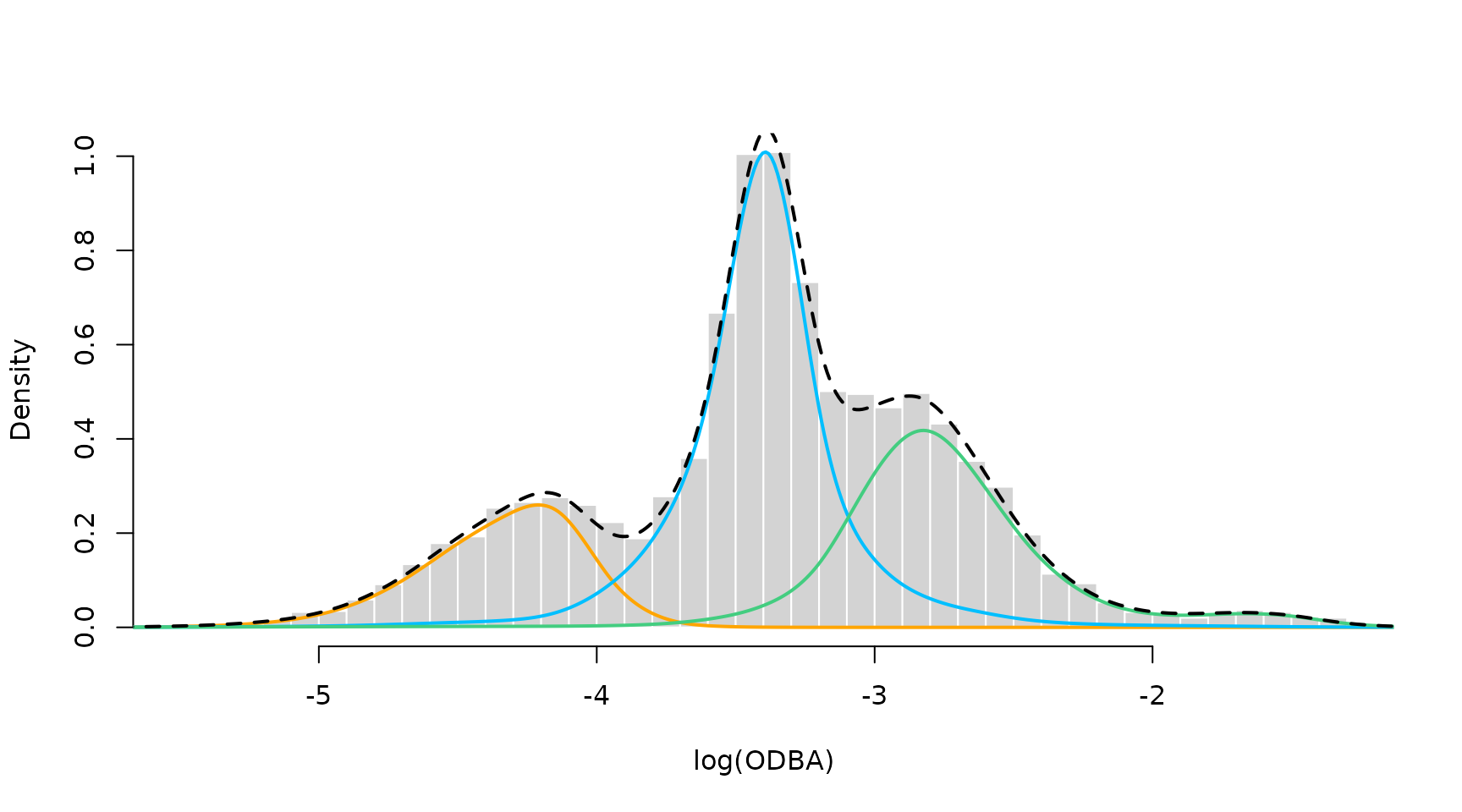

#> 8.617 3.461 7.965After fitting the model, we can easily visualise the smooth densities

using the prepared prediction objects. We already have access to all

reported quantities because qreml() automatically runs the

reporting after model fitting.

sDens = Z_p %*% t(mod2$alpha) # all three state-dependent densities on a grid

hist(nessi$logODBA, prob = TRUE, breaks = 50, bor = "white", main = "", xlab = "log(ODBA)")

for(j in 1:3) lines(xseq, mod2$delta[j] * sDens[,j], col = color[j], lwd = 2)

lines(xseq, colSums(mod2$delta * t(sDens)), col = "black", lwd = 2, lty = 2)

The P-Spline model results in a very good fit to the empirical distribution. This is because the first state has a skewed distribution, the second state has a high kurtosis and the third state has a funny right tail. The P-Spline model can capture all of these features where the parametric model failed to do so.

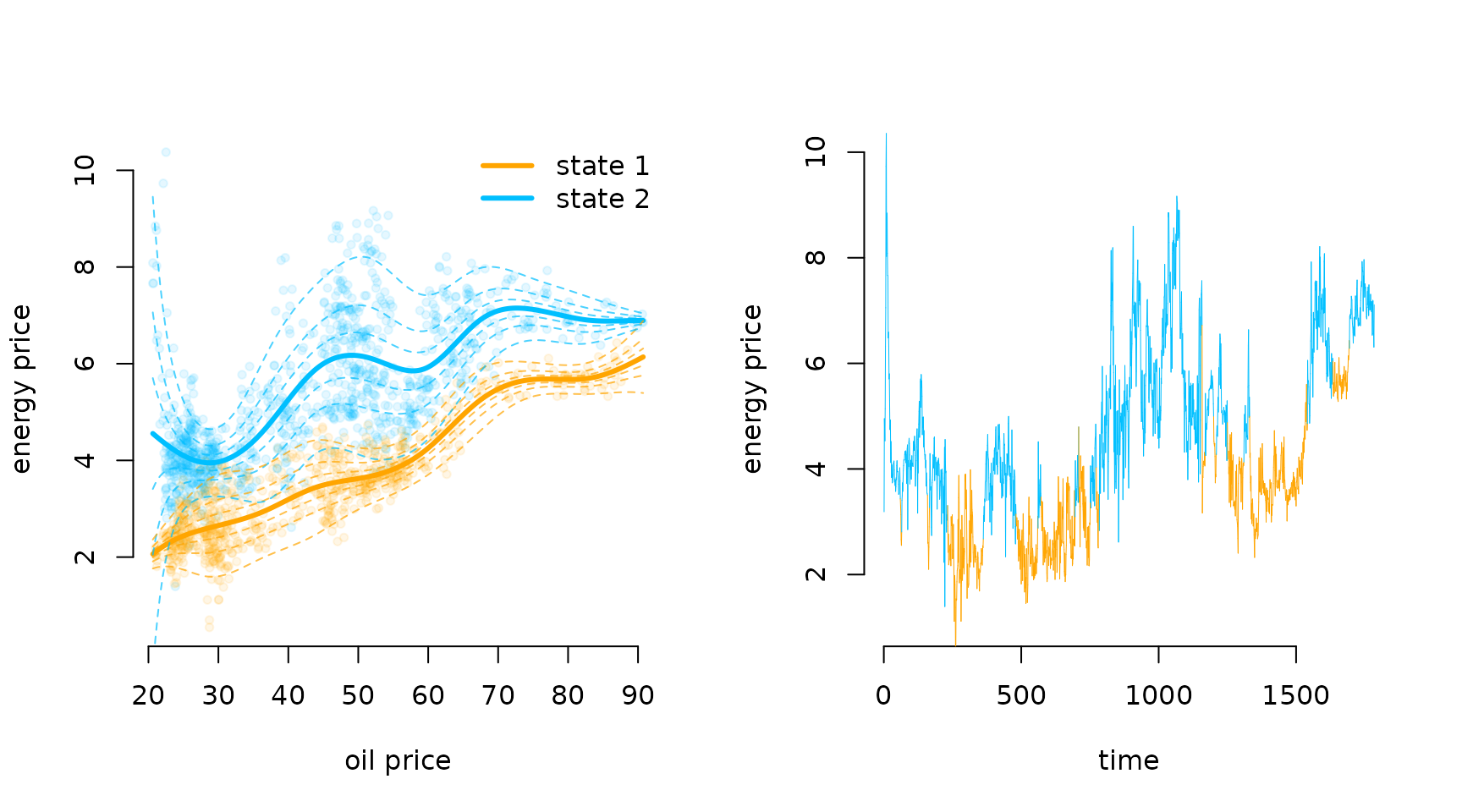

Markov-switching GAMLSS

Lastly, we want to demonstrate how one can easily fit

Markov-switching regression models where the state-dependent means and

potentially other parameters depend on covariates via smooth functions.

For this, we consider the energy data set contained in the

R package MSwM. It comprises 1784 daily observations of

energy prices (in Cents per kWh) in Spain which we want to explain using

the daily oil prices (in Euros per barrel) also provided in the data.

Specifically, we consider a 2-state MS-GAMLSS defined by

\text{price}_t \mid \{ S_t = i \} \sim N \bigl(\mu_t^{(i)},

(\sigma_t^{(i)})^2 \bigr),

\mu_t^{(i)} = \beta_{0,\mu}^{(i)} + s_{\mu}^{(i)}(\text{oil}_t), \quad

\text{log}(\sigma_t^{(i)}) = \beta_{0, \sigma}^{(i)} +

s_{\sigma}^{(i)}(\text{oil}_t), \quad i = 1,2,

not covering other potential explanatory covariates for the sake

of simplicity.

data(energy, package = "MSwM")

head(energy)

#> Price Oil Gas Coal EurDol Ibex35 Demand

#> 1 3.188083 22.43277 14.40099 38.35157 1.134687 8.3976 477.3856

#> 2 4.953667 22.27263 19.02747 38.35157 1.106439 8.3771 609.1261

#> 3 4.730917 22.65383 18.48417 38.35157 1.106684 8.5547 650.3715

#> 4 4.531000 23.67657 18.30143 38.35157 1.116819 8.4631 647.0499

#> 5 5.141875 23.67209 14.55602 38.35157 1.122965 8.1773 627.9698

#> 6 6.322083 23.60534 15.22485 38.35157 1.122460 8.1866 693.2467Similar to the first example, we can prepare the model matrices using

make_matrices():

modmat = make_matrices(~ s(Oil, k = 12, bs = "ps"), energy)

Z = modmat$Z # design matrix

S = modmat$S # penalty matrix (list)Then, we specify the penalised negative log-likelihood function. It

differs from the first example as the state-dependent distributions, as

opposed to the state process parameters, depend on the covariate.

Additionally, we now have two completely separated spline-coefficient

matrices/ random effects called betaSpline and

alphaSpline for the state-dependent means and standard

deviations respectively. Thus, we need to pass them as a list to the

penalty() function.

We also pass the penalty matrix list S that is provided

by make_matrices(). This could potentially be a list of

length two if the two spline coefficient matrices were penalised

differently (e.g. by us using a different spline basis). In this case,

however, they are the same and we only pass the list of length one. It

does not matter to penalty() if we pass a list of length

one or just one matrix.

pnll = function(par) {

getAll(par, dat)

Gamma = tpm(eta) # computing the tpm

delta = stationary(Gamma) # stationary distribution

# regression parameters for mean and sd

beta = cbind(beta0, betaSpline); REPORT(beta) # mean parameter matrix

alpha = cbind(alpha0, alphaSpline); REPORT(alpha) # sd parameter matrix

# calculating all covariate-dependent means and sds

Mu = Z %*% t(beta) # mean

Sigma = exp(Z %*% t(alpha)) # sd

allprobs = cbind(dnorm(price, Mu[,1], Sigma[,1]),

dnorm(price, Mu[,2], Sigma[,2])) # state-dependent densities

- forward(delta, Gamma, allprobs) +

penalty(list(betaSpline, alphaSpline), S, lambda)

}From this point on, the model fit is now basically identical to the

previous two examples. We specify initial parameters and include an

intial penalty strength parameter in the dat list.

# initial parameter list

par = list(eta = rep(-4, 2), # state process intercepts

beta0 = c(2, 5), # state-dependent mean intercepts

betaSpline = matrix(0, nrow = 2, ncol = 11), # mean spline coef

alpha0 = c(0, 0), # state-dependent sd intercepts

alphaSpline = matrix(0, nrow = 2, ncol = 11)) # sd spline coef

# data, model matrices and initial penalty strength

dat = list(price = energy$Price,

Z = Z,

S = S,

lambda = rep(1e3, 4))

# model fit

system.time(

mod3 <- qreml(pnll, par, dat, random = c("betaSpline", "alphaSpline"))

)

#> Creating AD function

#> Initialising with lambda: 1000 1000 1000 1000

#> outer 1 - lambda: 466.896 374.247 432.358 329.654

#> outer 2 - lambda: 250.283 143.698 200.372 113.051

#> outer 3 - lambda: 126.064 57.828 99.173 42.157

#> outer 4 - lambda: 72.846 26.191 56.901 18.27

#> outer 5 - lambda: 48.019 14.491 35.924 9.766

#> outer 6 - lambda: 35.991 10.081 24.159 6.518

#> outer 7 - lambda: 29.871 8.365 17.317 5.192

#> outer 8 - lambda: 26.631 7.684 13.359 4.626

#> outer 9 - lambda: 24.863 7.41 11.104 4.375

#> outer 10 - lambda: 23.88 7.297 9.836 4.263

#> outer 11 - lambda: 23.325 7.25 9.13 4.213

#> outer 12 - lambda: 23.007 7.23 8.74 4.189

#> outer 13 - lambda: 22.822 7.22 8.525 4.178

#> outer 14 - lambda: 22.719 7.216 8.406 4.173

#> outer 15 - lambda: 22.655 7.214 8.342 4.171

#> outer 16 - lambda: 22.618 7.213 8.305 4.17

#> outer 17 - lambda: 22.598 7.213 8.286 4.169

#> outer 18 - lambda: 22.589 7.212 8.279 4.169

#> outer 19 - lambda: 22.588 7.212 8.277 4.169

#> Converged

#> Final model fit with lambda: 22.588 7.212 8.277 4.169

#> user system elapsed

#> 8.283 4.691 7.321Having fitted the model, we can visualise the results. We first

decode the most probable state sequence and then plot the estimated

state-dependent densities as a function of the oil price, as well as the

decoded time series. For the former, we again create a fine grid of oil

price values and use predict() to build the associated

interpolating design matrix.

xseq = seq(min(energy$Oil), max(energy$Oil), length = 200) # sequence for prediction

Z_p = predict(modmat, newdata = data.frame(Oil = xseq)) # prediction design matrix

energy$states = viterbi(mod = mod3) # decoding most probable state sequence

Mu_plot = Z_p %*% t(mod3$beta)

Sigma_plot = exp(Z_p %*% t(mod3$alpha))

library(scales) # to make colors semi-transparent

par(mfrow = c(1,2))

# state-dependent distribution as a function of oil price

plot(energy$Oil, energy$Price, pch = 20, bty = "n", col = alpha(color[energy$states], 0.1),

xlab = "oil price", ylab = "energy price")

for(j in 1:2) lines(xseq, Mu_plot[,j], col = color[j], lwd = 3) # means

qseq = qnorm(seq(0.5, 0.95, length = 4)) # sequence of quantiles

for(i in qseq){ for(j in 1:2){

lines(xseq, Mu_plot[,j] + i * Sigma_plot[,j], col = alpha(color[j], 0.7), lty = 2)

lines(xseq, Mu_plot[,j] - i * Sigma_plot[,j], col = alpha(color[j], 0.7), lty = 2)

}}

legend("topright", bty = "n", legend = paste("state", 1:2), col = color, lwd = 3)

# decoded time series

plot(NA, xlim = c(0, nrow(energy)), ylim = c(1,10), bty = "n",

xlab = "time", ylab = "energy price")

segments(x0 = 1:(nrow(energy)-1), x1 = 2:nrow(energy),

y0 = energy$Price[-nrow(energy)], y1 = energy$Price[-1],

col = color[energy$states[-1]], lwd = 0.5)